**Secure Home Inspections HERS Energy Rater Division Launches in 2023**

What is the 45L Tax Credit?

Otherwise known as “The energy efficient home credit “, which provides eligible contractors up to a $5,000 tax credit for each energy efficient dwelling unit, is retroactively available for projects placed in service from 2020 to 2022, and through the end of 2032.

When did the 45L Tax Credit Start?

The Section 45L tax credit has existed since 2006 and most recently expired at the end of 2021.

Congress has passed, and President Biden has signed into law the Inflation Reduction Act. This important legislative action includes provisions regarding the 45L tax credit.

Who is the 45L Tax Credit For?

This Tax Credit is intended for single-family builders and multifamily developers (not homeowners).

When Did the Tax Credit Originally Expire?

December 31, 2021

Why Did the Tax Credit Get Extended and How Long?

It has now been extended until December 31, 2032.

You can read the entire 725 page Inflation Reduction Act. or just jump to page 367 where it talks about the changes to the 45L tax credit [Section 13340]..

The Inflation Reduction Act (IRA) was recently signed to be extended on August 16th. This means several exciting things for the clean energy world including:

- Increasing the Solar Tax Credit (ITC) to 30%

- Extending the existing 45L Tax Credit for energy-efficient single-family and multifamily homes for the next 10 years!

- Increasing the tax credit to $2,500 per home if it meets the eligibility standards of the EPA’s Energy STAR Single Family New Homes Program.

- $5000 tax credit to homes that are certified to meet the DOE’s Zero Energy Ready Home program. Zero Energy Ready Homes Requirements

How much money can you get with the tax credit?

- For homes acquired (closed or leased) from 1/1/2021 to 12/31/2022: $2,000

- For homes acquired (closed or leased) from 1/1/2023 to 12/31/2024:

- Homes that qualify for ENERGY STAR v3.1: $2,500

- Homes that qualify for DOE Zero Energy Ready: $5,000

- For homes acquired (closed or leased) from 1/1/2025 to 12/31/2032:

- Homes that qualify for ENERGY STAR v3.2: $2,500

- Homes that qualify for DOE Zero Energy Ready: $5,000

What Single Family Homes Qualify For The Tax Credit?

To qualify, the homes must receive a HERS Rating at minimum to demonstrate that the heating and cooling energy loads are 50% more efficient than a comparable house built to the 2006 IECC AND that building envelope improvements account for at least ⅕ of the 50% energy savings.

For example – if a builder starts a house today and it closes on January 2, 2023, it will need to be ENERGY STAR v3.1 Certified to get the tax credit.

What Are The Steps and How Does The 45L Tax Credit Work?

Starting in 2023 and beyond, Secure Home Inspections will run a free ENERGY STAR and/or DOE Zero Energy Ready Program analysis to help you understand how to qualify for the new tax credit.

Are You 45L Compliant?

If it all seems overwhelming, don’t worry that is what we are here for. To find out if the homes you are building qualify CLICK HERE.

Looking for information on multifamily 45L Tax Credits? CLICK HERE

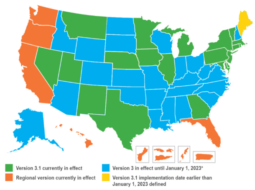

The map of where versions of ENERGY STAR are in effect is posted below: